The next major mega-shift - alternative protein

By Paul Cuatrecasas on Thursday 2 September 2021

By Paul Cuatrecasas on Thursday 2 September 2021

Over the next 5 to 15 years there will be a revolution in the food industry that will feel like the disruption of the horse and cart back in the early 1900s by the automobile – the transformation will extend across the entire global food value chain, from fark to fork.

By 2030 the food industry will look dramatically different from how it looks today. One of the key disruptors for this change is the rise of “Alternative Protein.”

There are seven basic categories we define as alternative protein.

Plant-based protein, which refers to products made from plant sources that are designed to imitate conventional meat, in taste, texture, smell, and appearance. Plant-based protein is primarily derived from grains and legumes used for their protein, fibre, and starch.

Cultured meat, sometimes referred to clean meat or lab meat, involves growing meat products from cells sourced from animal muscle and tissue in a laboratory without having to raise process and kill animals.

Cultured fish, or cellular fish, combines developments in biomedical engineering, with modern aquaculture techniques to culture cells in tanks and transform them into a consumable product using processes such as extrusion.

Insect protein, which is derived by milling insects for flour and then isolating the protein from the flower. Commonly used insects are crickets and grasshoppers.

Fermented protein, which is used to produce animal proteins, such as casein and whey, through a brewing process whereby yeast organisms are programmed to produce the proteins more efficiently.

Mycoprotein, which are proteins made from Fusarium venenatum, a naturally occurring fungus. Fungi spores are fermented along with glucose and other nutrients resulting in a doughy mixture, with a meat-like texture that's high in protein and fibre

Algae, which is a rich source for producing and harvesting protein biomass derived from macro and microalgae.

While we look back over thousands of years where animal meat has been a primary source of protein, there's a paradigm shift coming, which will seem to happen almost overnight with the advent of these alternative protein sources.

As a background for why we believe alternative protein is quickly emerging as the future of food, it is worth noting the new frontier that companies operating in the food ecosystem have to move towards and conquer if they want to survive and thrive. We call this new frontier the "2025 Winners’ Quadrant", which is where companies need to meet all the consumer needs that are rapidly emerging.

These needs demand that food is more healthy, tastier, and more sustainable, which means no plastics, of course, but also sugar-free, gluten-free, ideally organic, with no GMO and no glyphosate or chemicals, pesticides, herbicides etc.

Consumers are wanting clean, tasty, delicious food, and they want it now. They want it conveniently delivered to them, and they want a wide choice. Even if they're eating out, they want it delivered to them as quickly as possible.

As humans are having to adapt their behaviour to this new world that has been turbocharged by the pandemic, there's an enhanced expectation that consumers have developed, of having things “now”; having things delivered to them on their doorstep. Whether it's Amazon or some other company, they don't want it a week from now, they want it in the next hour, and within food, they'll want it in a matter of minutes as soon as drone deliveries start to appear.

This consumer demand for health and wellness and global drive towards sustainability is key in a shift from animal protein to alternative protein, which has been accelerated by the COVID-19 pandemic. Alternative protein is altering the landscape fundamentally across all protein categories from meat, to fish to eggs to dairy, with projections that meat alternatives will capture 10% and 60% of the conventional meat market by 2025 and 2040, respectively.

As this type of food changes at source, it affects how it's being delivered and how it's being processed, distributed, and sold. It affects the manufacturing and processing chain, the distribution, supply and retail chain, and ultimately how consumers are consuming the food.

In 1905 the market share for transportation between horse and cart was ca 97.5% horse and 2.5% automobile. But in only 20 years that market share completely flipped a switch, and the automobile market share grew to 95% while the horse and cart market share had declined to only 5%. That's an effective overnight shift. We expect to see a similar shift in alternative protein to happen even faster. This is not the only shift; there have been many others, such as the photo film (ie Kodak) shifting to digital.

This mega-shift in food is interesting and important for many reasons, one of them environmental. On average, humans slaughter over 70 billion animals a year for food. That's 130,000 animals every minute.

The global meat market today is large. Globally, it's $1 trillion, as determined by the United Nations and the World Bank. The World Economic Forum says that the amount of food we're growing today will only feed half the population by 2050. So, we have this growing population that will also want to be meat-eaters. We expect that by 2040, in only 20 years, 60% of all meat consumed in the world will be meat alternatives, rather than conventional animal protein meat.

Why this is so significant about these statistics isn't just the size of the economics but also the sustainability. With plant-based protein, for example, Impossible Foods claims that its carbon footprint of an “Impossible Burger” is 90% smaller than a burger made from a cow, and uses 87% less water and 96% less land. Indeed, plant-based foods may have about one-tenth the carbon costs of animal-based foods.

Cultured meat generally claims to use 99% less land and 90% less water, and could also reduce greenhouse gas emissions by as much as 95%, whilst only using 55% of energy relative to conventional beef.

With cultured fish, there are claims of shorter cycle time as cell cultures require only a few weeks to a few months to generate functional foods, as compared to 2 to 3 years for a normal salmon, for example, to grow to market size. There are an estimated 1 to 3 million fishes harvested commercially for food each year, and the global per capita consumption of fish has risen to over 20 kg per year per person. This could mean a massive reduction in over-fishing.

Insect protein is made up of 60-70% dry matter, although it depends on the specific species, they're high in protein, quite nutritious, rich in unsaturated fatty acids, minerals, and vitamin B compared to plant-based protein. Insects require 12 times less food than beef does for the same edible weight, 2,000 times less water requirement than needed to produce beef, and 100 times less GHG emissions. In 2019, just 9 million people, about 2% of the population in the EU ate insects, partly due to the lack of availability and tastes, which we think will change and improve over time.

In fermented protein, which is a pre-digested protein, making it easier for the stomach to digest, one finds a greater bioavailability of nutrients. It tends to remove anti-nutrients and harmful bacteria, which is becoming increasingly important as a concern. There is a greater absorption of protein and it can reduce or eliminate carbohydrates.

Fermented protein is also efficient at converting calories into protein and high-value molecules, alongside reducing pollutants, GHG emissions and saving water and land. The cost has decreased from $1 million per kg in 2000 to only $100 per kg today, and it is estimated to decline below $10 per kg by 2025 and end up actually 5 times cheaper than animal equivalents by 2030.

Regarding Mycoprotein, the protein content can range from 40% to 60% and it is high in fibre with limited carbohydrates and contains no cholesterol. It uses 90% less land and produces 90% fewer carbon emissions than beef. This type of protein is energy efficient as dairy alternatives, using only 15 to 20 kilowatts per kg.

Algae doesn't require pesticides for productivity, and allow growth in wastewaters, with an ability to be grown year-round and double their biomass in as little as one to three days. So, animal proteins from insects, algae, and fungi, which require neither arable land nor freshwater are not only packed with nutrients, but also reduce the pollutants released into the environment.

Animal proteins that relate to plant-based protein and cultured meat and cultured fish are also not only cruelty-free but have 80 to 90% lower ecological impact that will maximise the intersection of human and environmental health.

The development of moving conventional animal protein to alternative protein will put the entire existing protein ecosystem at risk.

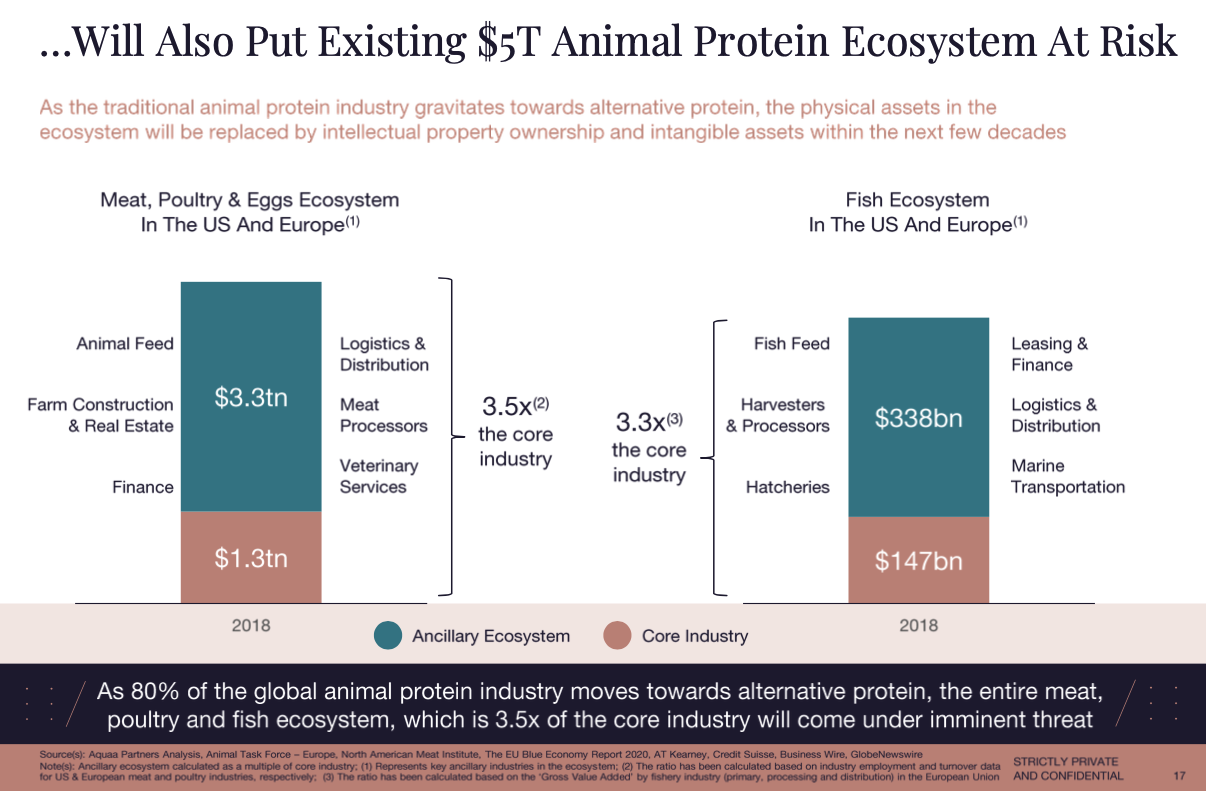

Today we have a market size of around $1.4 trillion in North America and Europe around the core businesses of meat, poultry, and eggs. However, when one adds the periphery ecosystem that depends on the core (and vice versa), such as logistics and distribution, meat processors, veterinary services, financing, farm construction, real estate and animal feed, among others, then one adds another $3.3 trillion of market size. In total, then, the North American and European markets for meat, poultry and eggs represent a total of nearly $5 trillion.

Similarly, the core fish industry in these geographies is estimated at approximately $150 billion. However, when one adds the periphery industries, such as the ecosystem of fish feed, harvesters and processors, hatcheries, leasing and financing, logistics and distribution and marine transportation, then one adds another $340 billion, for a total market size of over $500 billion in the fish ecosystem.

This means that as we move to alternative protein, we're looking at a devastating impact on the meat and poultry ecosystem as we know it today.

For the meat, poultry, and eggs industry, there are about 77 billion land animals that are currently slaughtered every year across the globe. In a world of alternative protein, these animals would not be killed anymore (or be born). This shift would render about 650 million tonnes of animal feed unusable, and which would impact the livelihood of about 1.3 billion people who are currently supported by the livestock sector globally via direct and ancillary industries.

Animal farms would no longer be needed, which would free up to 40 million square kilometres of land and the related labour and material.

Animal farm equipment would no longer be needed, nor the corresponding repair and maintenance industry related to that equipment.

The demand for fuel used in livestock transportation, energy generation, and farm equipment would substantially reduce. Meat processing factories would be rendered redundant.

The supply chain of meat, eggs, and poultry from farms to retailers would not be required, as production and processing can either happen locally, for example through 3D printing, or be sent directly to consumers via B2C.

The global veterinary pharmaceuticals market would be massively impacted, as livestock currently contributes about 54% to the market size.

Animal protein will not just disrupt the processors and producers, but the entire economy and the entire ecosystem that supports the food value chain, while also allowing a B2C strategy to be more feasible for new producers.

Similarly, the fish industry and ecosystem as we know it today will no longer exist.

Today about 2 trillion fish are killed every year by humans. At least 1.3 trillion of these fish would not be harvested anymore with the advent of cultured fish. This would render about 3 million fishing vessels unusable, and about 60 million people would require alternative employment and re-skilling.

Aquaculture farms will be replaced by lab-grown fish assembly lines. Manufacturing assembly of commercial fishing vessels, including raw materials and labour, will be massively impacted.

The transportation chain from fisheries and processors to final retailers will not be required, because of local production and increased shelf life of cultured fish. Fueling stations and fuel required for transportation will see a massive drop in demand.

Commercial fishing equipment and its repair and maintenance will be largely rendered useless. Fish feed as an industry will lose commercial significance over time. By transmuting from killed to cultured fish with better taste, cleaner, and a lower cost, the world will be transformed.

Alternative protein companies are already growing strong. Before 2010 we had on average about 10 to 15 significant alternative protein companies being founded. Then, from 2010 to 2015 there were another 20 to 30 interesting companies founded. However, in the past five years from 2016 to 2020 there were over 50 interesting companies founded and growing rapidly from the application of complex disruptive technologies such as synthetic biology, big data, AI, machine learning, robotics, and Internet of Things.

Plant-based alternative protein companies have been around for decades. However, new technologies today are enabling new companies to form and flourish as consumers become more ESG aware and as taste improves.

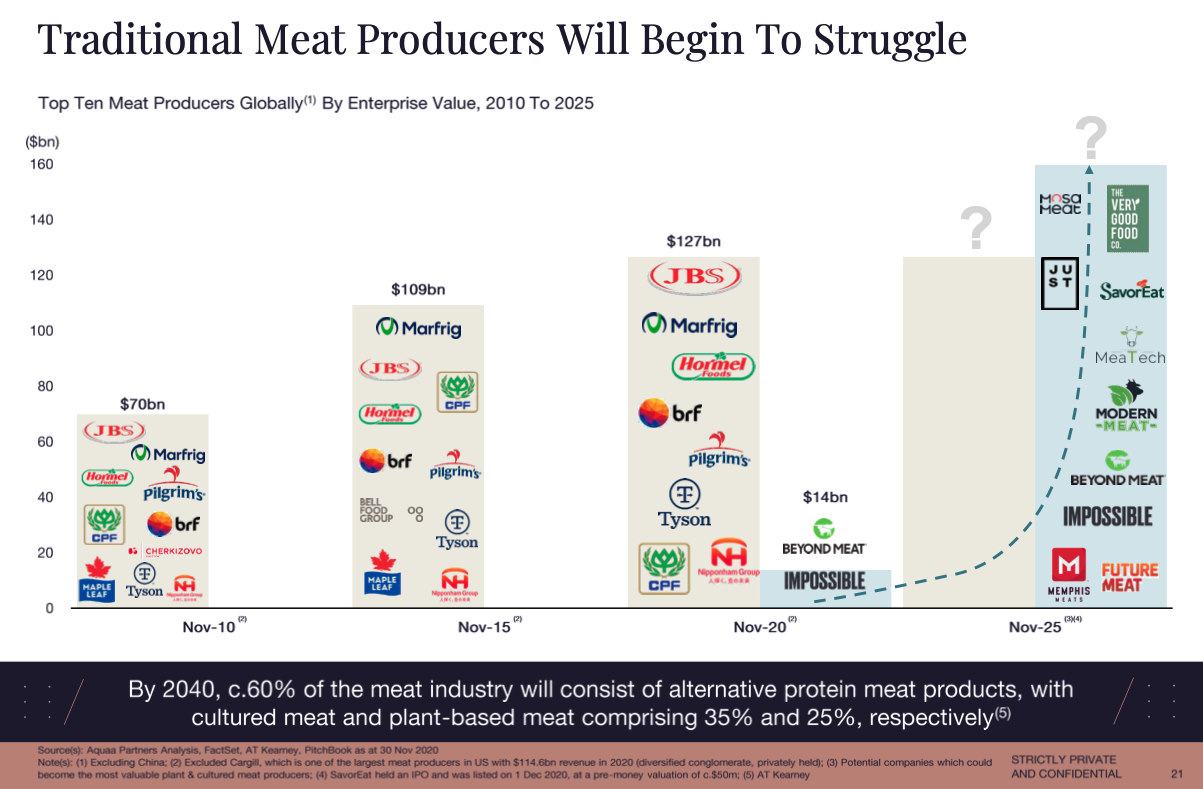

The top ten meat producers globally by enterprise value in November 2010 amounted to about $70 billion. Five years later, in November 2015 that enterprise value grew to about $110 billion. Another five years later, in November 2020, the value of these top ten companies grew to $130 billion. However, in November 2020, we found that out of that top 10, two of the top ten companies were alternative protein companies, Beyond Meat and Impossible Foods, with a combined valuation of $14 billion.

Based on the exponential growth of advanced technology we are experiencing today, we project that by November 2025 the alternative protein companies will have a greater enterprise value than the traditional meat producers, which could well be lower than today's $130 billion.

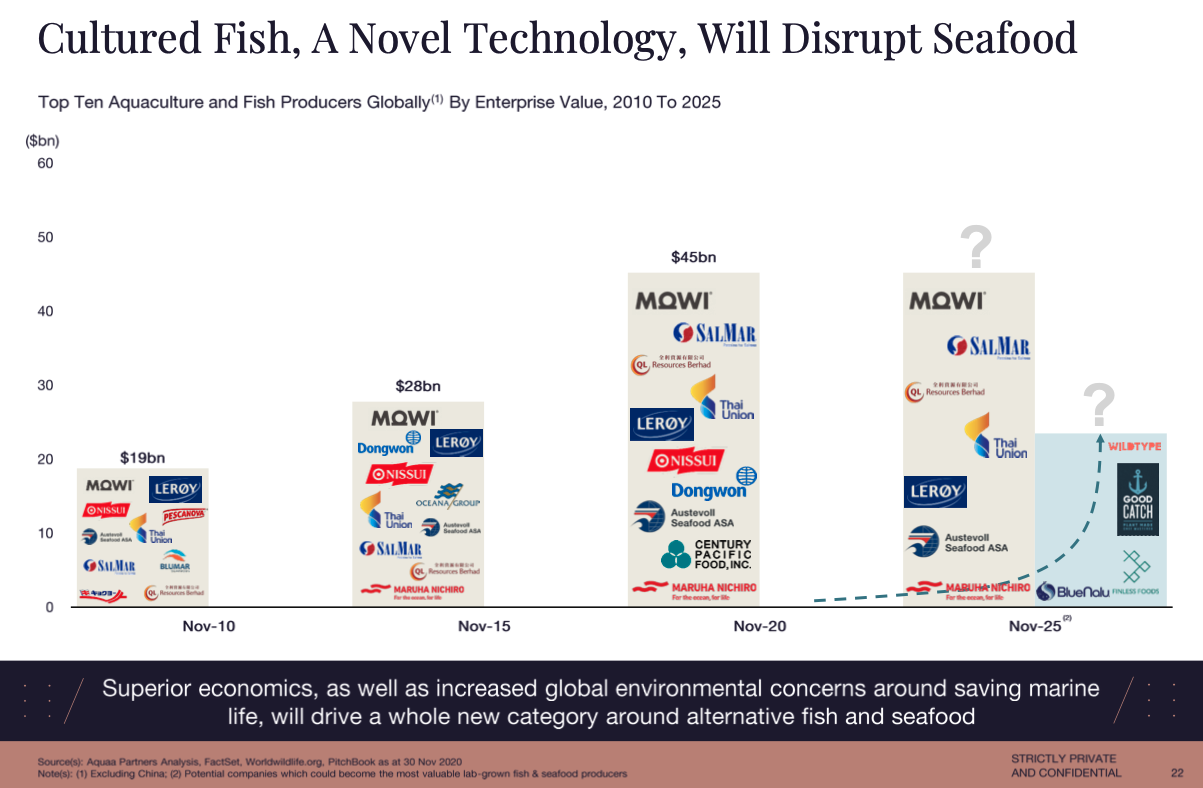

In a similar way to meat, cultured fish will begin to disrupt the traditional seafood producers and ecosystem.

While the top 10 aquaculture and fish producers globally have grown their enterprise value from $19 billion in November 2010 to $45 billion in November 2020, we believe that this growth will begin to flatten out by around 2025 / 2026, and the alternative fish companies will start to grow and ultimately take a major piece of that market share.

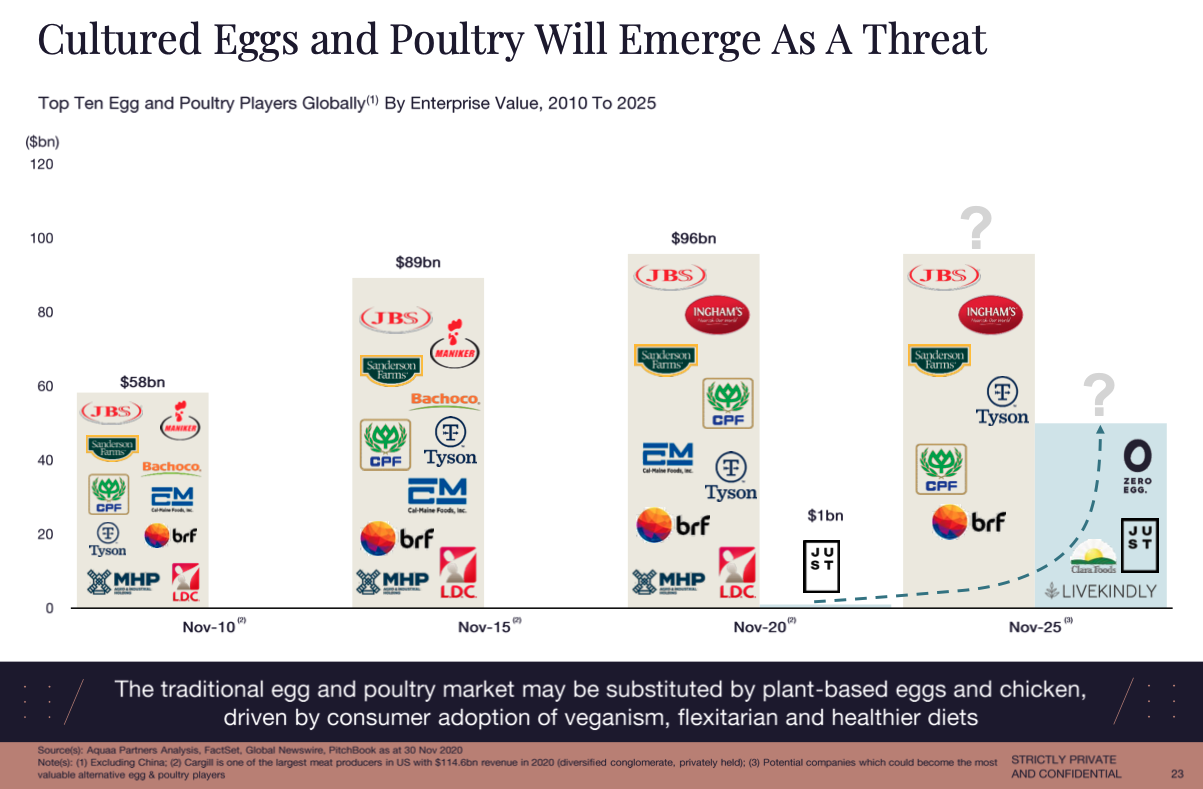

In a similar way to meat and fish, cultured eggs and poultry will emerge as a threat to the traditional egg and poultry players.

Back in November 2010, the top 10 egg and poultry producers commanded about $60 billion of enterprise value, which grew to about $90 billion five years later in November 2015. By 2020 the enterprise value of these top ten began to stagnate. The total enterprise value did grow to $96 billion by November 2020, but we expect this will start to decline by 2025, while alternative eggs and poultry will start to act as a substitute, driven by consumer adoption of veganism, flexitarian, and healthier diets.

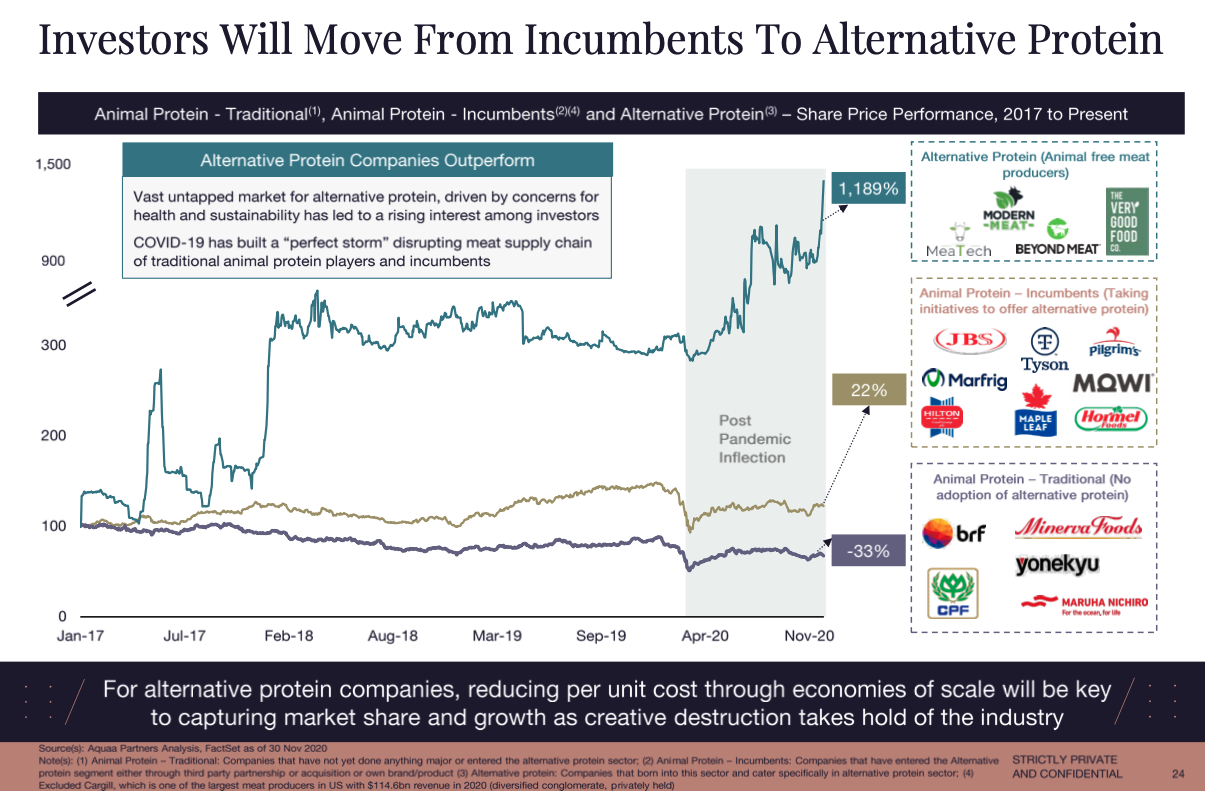

We have already seen investors begin to move from incumbents to alternative protein.

In the four years from January 2017 to the end of 2020, the traditional animal protein companies such as BRF, CPF, Minerva Foods, and Yonekyu declined by 33% on average in terms of share price.

The animal protein incumbents, such as JBS, Tyson Pilgrims, Hormel, Maple Leaf, Malfrig, and Hilton Foods grew by 22% on average during this period.

The quoted companies at the time in alternative protein – MeaTech, Modern Meat, Beyond Meat, and The Very Good Food Company – grew by nearly 1,200%.

For alternative protein companies, reducing per-unit costs through economies of scale will be key in capturing market share and growth as creative destruction takes hold of the industry.

Traditional food producers have come under pressure already. There have been multiple bankruptcies due to the shift in consumer preferences and financial pressures.

Kane went bankrupt in January 2019. Dean Foods, the dairy company, went bankrupt in November 2019. Borden went bankrupt in January 2020. B.I. Foods, the meat producer, went bankrupt in May 2020.

Now the industry is under additional pressure from the coronavirus pandemic. Virus outbreaks in factories dealt major blows to the meat supply chain, which is estimated to have faced losses of over $20 billion in 2020. Traditional meat producers already under stress are now facing increasing pressures with changing consumer preferences and supply chain disruption due to COVID-19, and the damage might be permanent.

Beef revenues will likely collapse first, followed by the chicken, pig, and fish industries. By 2030, the US cattle industry might go bankrupt and all other livestock and commercial fisheries will follow a similar trajectory.

In fact, by 2035, 60% of the land currently used for livestock and feed production will be freed for other uses. These 485 million acres equates to 13 times the size of Iowa. Pat Brown, the founder of Impossible Foods, said "we want to completely replace animals as a food production technology by 2035. We are working on producing all foods that we humans get from animals."

Animal protein players must transform in this environment to generate returns.

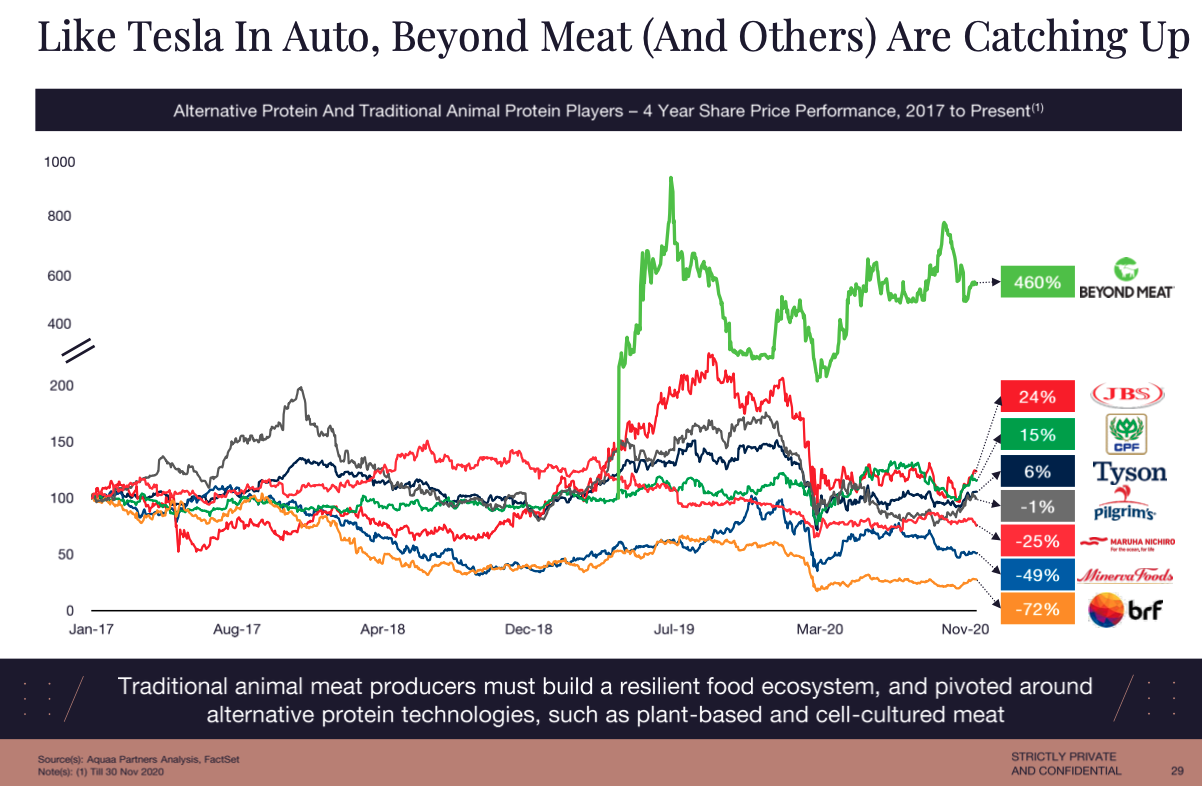

Coming back to share price performance, in the last four years from January 2017 to the end of 2020 the top quoted animal protein producers grew by only 3%, while the S&P 500 over that four-year time frame grew by 62%.

So, these traditional animal meat producers are already under pressure. They're consistently underperforming the broader market index, reflecting the underlying stress that the sector is facing.

Like Tesla and the automotive sector, Beyond Meat and others are catching up. In fact, if we look again at the same four-year period, companies like BRF declined 72%, Minerva foods declined 49%, Maruha Nichiro declined 25%, Pilgrims declined by 1%. Tyson only grew by 6%, CPF grew by only 15% and JBS only grew by 24%. However, Beyond Meat grew by 460%.

There is a new order around health, taste, personalization, ESG, and convenience. They are the driving forces of food. In convenience, customers are turning to fresh and prepared food items, primarily for convenience factors. When consumers were asked in an SMG survey about what are the main benefits of fresh-and-prepared food items, convenience was the primary consideration; 53% of respondents cited saves time on cooking, and 39% saves time with meal planning.

Food delivery services are also set to benefit from the convenience they offer to consumers. In a survey by Global Web Index, 47% said they were excited by 24/7 service.

Another 32% said they were excited by orders that are personalised to their tastes and preferences, while 31% are excited by more grocery, coffee, and retail chains being added. We are definitely going to see more B2C alternative protein companies.

A survey conducted by Leatherhead Food Research found that 50% of consumers are trying to eat less sugar, 17% are trying to eat more protein, 33% are trying to eat less meat, 10% are trying to cut gluten, and 42% have incorporated foods into their diet because they think they'll improve their health.

In terms of ESG there are great savings in water use, GHG emission, and land use. In terms of taste, in a global survey conducted by Candy Industry, 49% of consumers said they would trade up for nutritional value, 56% would trade up if the food is natural, and 58% would trade up if it's great taste. 93% of more than 2,004 of US consumers surveyed said that the taste of a food and beverage product influences their interest in it.

In a survey by the Deloitte Consumer Review called the “Made-to-order: The rise of mass personalization” the interest in personalised food and groceries by age groups was analysed: 38% of consumers were found to be prepared to pay a 10% or higher premium for a customised product or service in food and grocery while 21% were prepared to pay 20% or higher premium. This is one reason why alternative protein is moving fast to the Winner's Quadrant.

Whatever role you play in the food industry, whether you're an alternative protein company, or you operate a grocery store, or perhaps you are in grocery delivery or operate a traditional restaurant, or you run a food processor or a meal kit company, or you operate a ghost kitchen or autonomous online grocery food delivery…you must be focused on food that is healthier, more sustainable, tastes better, but also delivered faster and more conveniently. It's one of the reasons that we've seen companies such as Impossible Foods offer their products direct to the consumer.

Alternative protein is becoming the future of food and we're seeing several companies take advantage of this. In January 2021 Mitsubishi Corp agreed to partner with Israel's Aleph Farms to bring cultured steak to Japan where the demand for meat is growing, and get access to Aleph's manufacturing BioPharm technology to cultivate whole muscle steaks from cattle cells without the use of animals. Singapore has just approved Eat Just cell-cultured chicken, making it the first country to approve selling meat created in a lab.

We've seen major brands reposition themselves to reflect the new reality. Cargill used to call itself “Cargill Meat Solutions”, it's now called “Cargill Protein”. Tyson used to call itself “A Meat Leader”, they now call themselves “A Protein Leader”. Maple Leaf used to call itself “Canada's Largest Food Processor”, they now call themselves “A Leading Consumer Protein Company”.

Traditional meat producers no longer want to be identified as meat companies but rather as protein companies as they acknowledge the trends.

But will this be enough? Alternative protein means the end of killing animals for food.

It's interesting to note that Winston Churchill said it back in 1931, "we shall escape the absurdity of growing a whole chicken in order to eat a breast or a wing by growing these parts separately under a suitable medium…the new foods will be practically indistinguishable from the natural products from the outset and any changes will be so gradual as to escape observation."

So, why has it taken so long? We didn't have the technology back then that we have today that allows us to deliver alternatives to the traditional way of producing meat and protein. Traditional meat processors, therefore, must transform their strategies to keep pace, or they risk becoming irrelevant or even worse, going extinct.

Alternative meat today has a total market of only about $4.6 billion, which represents a small fraction of the $1 trillion global meat market. We believe it could soon grow by 50% per year, depending on the region, over the next several years.

Driven by the high commercial potential on similarity and taste, plant-based and cultured meat have tremendous potential to disrupt the $1 trillion conventional meat industry.

In 2025, we expect the conventional meat market to decline to only 90% of the total meat market, with 10% being comprised of plant-based meat. We believe that by 2030, conventional meat market share will decline to 72%, with 18% being plant-based meat and 10% cultured meat. By 2035, conventional meat market share will decline to 55% with plant-based meat representing 23% and cultured meat representing 22%. By 2040 we expect the conventional meat market globally to decline to a 40% market share, 25% being comprised by plant-based meat and 35% being comprised of cultured meat.

We are expecting to see a similar shift in the alternative poultry and eggs market, and the alternative seafood market.

It is the power of intellectual property that favours alternative protein companies. Supplier power for the alternative protein companies will increase as they own the intellectual property and they start to corner the market for the agricultural supply of things, like pea and legume protein, and the buyer power will also grow in parallel with concerns around health and environmental sustainability.

However, the threat of new entrants’ may be relatively low as long as capital is available to invest in R&D and new technologies. There will also be a variety of different substitutes, as I pointed out with the seven different categories of alternative protein.

Now, alternative protein producers do have and attract far higher valuations.

For example, with traditional animal protein companies, the BodyValue (the enterprise value per employee in a company), was only $68,000 at BRF, $106,000 at Minerva, $157,000 at CPF, and $227,000 at Yonekyu. So, the average body value of traditional animal protein companies was only $123,000.

In terms of the animal protein incumbents JBS, Tyson MQWU, and Hormel Foods, the average body value was $227,000, considerably higher.

However, using the valuations of the alternative protein companies at the same time (November 2020) – Just, Impossible Foods, The Very Good Food Company, and Beyond Meat – the average BodyValue is over $12 million per employee. That is over 40 times higher than the average employee value of animal protein incumbent companies.

These high valuation levels are one of the reasons why so much capital is being attracted from the traditional incumbent players to the newly emerging alternative protein companies.

We're also seeing a surge in venture capital funding with alternative protein companies: in 2017, $488 million of VC equity funding went into alternative protein companies as 54 deals were done. That grew the year later to 2018 to $736 million, with 89 deals being funded, and it grew further in 2019 to $1.5 billion in funding with 122 deals, and an IPO of Beyond Meat in 2019.

Then the amount of VC funding grew even further. Last year in 2020, even during the global pandemic, $3.6 billion was raised in the alternative meat sector, with 124 deals and three IPOs, SavorEat, Modern Meat, and The Very Good Food Company.

Therefore, from both the public markets and private markets perspective, there's a huge amount of capital now that's going into these alternative protein companies.

There's also a quoted venture capital firm traded on the London AIM market – Agronomics – that has grown its share price, quite strongly from about 4p in August 2018 to over 16p in early 2021 because of its aggressive investment in some of the best alternative protein companies in the world.

In summary, Alternative Protein is a hot sector, only set to grow and attract higher valuations and greater funding, as the technology becomes approved worldwide, and we start to see more alternative protein products on our shelves.

Consumer habits and preferences are shifting in favour of these products, and the tech companies are nimble enough to pivot and deliver the level of personalisation, convenience, and health benefits that are increasingly being demanded by consumers everywhere.

2 August 2021

Paul Cuatrecasas

13 September 2021

Paul Cuatrecasas

30 June 2021

Paul Cuatrecasas

9 September 2021

David Stevenson